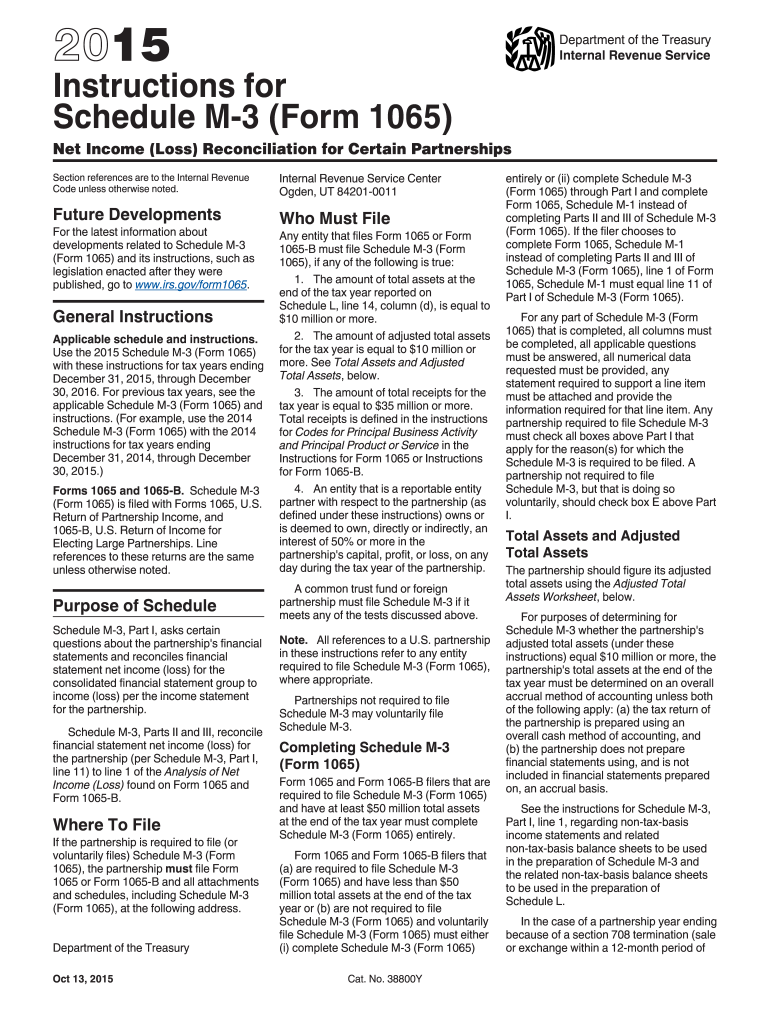

standardize the format and methods for the international reporting for pass-through entities.The new Schedule K-2 and Schedule K-3 replace and supplement the reporting of items that were previously reported (often in less detail) on Schedules K and K-1. distributions from a foreign corporation that are treated as dividends or excluded from gross income because they are attributable to previously taxed earnings and profits (PTEP).inclusions of subpart F income and Global Intangible Low-Taxed Income (GILTI) and.IRC §250 deduction with respect to foreign-derived intangible income (FDII).foreign tax credits (income or loss by source and separate category of income).

Items of international tax relevance include information partners and shareholders need to determine their: However, pass-through entities with no international tax items to report do not have to file the schedules. The new schedules must be filed by all pass-through entities with items of international tax relevance, including foreign partners and international activities. However, the IRS may waive penalties for filers that fail to comply with the new rules.

The S corporation or partnership must also provide Schedule K-3 to its shareholders or partners. Persons With Respect to Certain Foreign Partnerships.

A partnership files the schedules with its Form 1065 or Form 8865, Return of U.S.

0 kommentar(er)

0 kommentar(er)